working capital turnover ratio can be determined by

This means that XYZ Companys working capital turnover ratio for the calendar year was 2. Can be calculated using the above formula.

Working Capital Turnover Ratio Interpretation College Adventures Ratio

Working capital turnover ratio can be determined by.

. The formula to determine the companys working capital turnover ratio is as follows. Finally the working capital turnover ratio of XYZ Co. How much working capital is enough and how is that determined.

Ratio dfrac280000140000 2 This company has a working capital turnover ratio of 2. Working Capital Turnover Ratio 288. Working capital can be calculated by subtracting the current assets from the current liabilities like so.

Net Sales Sales Returns. Working Capital Current Assets Current Liabilities or COGS Net Sales Gross Profit or Opening Stock Purchases Closing Stock. Therefore the working capital ratio for XYZ Limited is 50.

150000 divided by 75000 2. Determine Working capital turnover ratio if Current assets is Rs 150000 current liabilities is Rs 100000 and Cost of goods sold is Rs 300000. A Gross ProfitWorking capital b Cost of goods soldNet sales c Cost of goods soldWorking capital d None of the above.

Cost of goods sold working capital d. Working capital turnover ratio can be calculated by dividing the net sales done by a business during an accounting period by the working capital. Working capital is calculated by subtracting current liabilities from current assets.

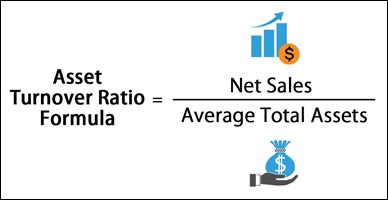

Working Capital Turnover Net Annual Sales Average Working Capital beginaligned textWorking Capital TurnoverfractextNet Annual Sales. Working Capital 2015 Current Assets 2015 Current Liabilities 2015 Working Capital Ratio 2015 4384 3534 124x. Determine Working capital turnover ratio.

One can improve the current ratio without changing the work-ing capital. Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. Determine Working capital turnover ratio if Current assets is Rs 150000 current liabilities is Rs 100000 and Cost of goods sold is Rs 300000.

Thus Working Capital Turnover Ratio 25 million 26 million 096. The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. Now we can calculate the working capital turnover ratio.

The working capital turnover ratio of XYZ Co. The company had average working capital of 2 million during the same financial year. Is below 10 and is not considered an ideal ratio because the working capital turnover is preferred above 10.

In the case of financial enterprises th. Working capital turnover ratio can be determined by. If you cannot read the numbers in the above image reload the page to generate a.

Calculating Working Capital Turnover Ratio. Net sales average working capital working capital turnover ratio. How to calculate a working capital turnover ratio.

Cost of goods sold Net sales. WC Turnover Ratio Revenue Average Working Capital. None of the above.

Where Net Sales Total Sales Sales Return. Working capital turnover ratio can be determined by. Which of the following are advantages of.

The formula to measure the working capital turnover ratio is as follows. Determine Working capital turnover ratio if Current assets is Rs 150000 current liabilities is Rs 100000. It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time.

Working capital turnover ratio is computed by dividing the net sales by average working capital. Before you can calculate your working capital turnover ratio you need to figure out your working capital if you dont know it already. The Formula for Working Capital Turnover Is.

Working Capital Turnover Ratio Turnover Net Sales Working Capital. What is Working Capital Turnover Ratio. Gross profit working capital 75.

This ratio is also known as Current Ratio Current Ratio The current ratio is a liquidity ratio that measures how efficiently a company can repay it short-term loans within a year. Listed Enterprises need to prepare Cash. Formula to Calculate Working Capital Turnover Ratio.

Working Capital Current Assets - Current Liabilities. Is there such a thing as too much work-. Use the following working capital turnover ratio formula to calculate the working capital turnover ratio.

Gross profit working capital b. Working Capital Turnover Ratio Analysis. Gross Profit Working capital b.

The balance of fixed assets of Y Ltd. Working Capital is calculated by. Occurs when comparing working capital and current ratio.

It can be represented in the form of a formula as follows. Working capital turnover ratio can be determined by. Working capital turnover ratio can be determined by.

Turnover days net of overunder billings plus inventory turnover days. If you cannot read the numbers in the above image reload the page to generate a. Cost of goods sold net sales c.

Working capital can be calculated by subtracting the current assets from the current liabilities like so. Gross profit Working capital B. The Balance sheet of Ram at end of 2013.

The formula consists of two components net sales and average working capital. Net Sales Sales Returns. This means that for every one dollar invested in working capital the company generates 2 in sales revenue.

C Cost of goods soldWorking capital 8. To do so take your current. 6 rows Working capital turnover ratio can be determined by.

At the end of a calendar year XYZ Company has 150000 in annual sales and 75000 in working capital. The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as a result. Working Capital Turnover Ratio helps in determining that how efficiently the company is using its working capital current assets current liabilities in the business and is calculated by diving the net sales of the company during the period with the average working capital during the same period.

Enter the code shown above. As per AS-3 Cash Flow Statement is mand. Managers utilizes marginal costing for.

Working capital Turnover ratio Net Sales Working Capital.

Chapter 7 Working Capital Management

The Financial Ratios Are Tool Used By Creditors Investors Stakeholders And Management Of A Co Financial Ratio Financial Statement Analysis Financial Analysis

20 Balance Sheet Ratios Every Investor Must Know Financial Ratio Bookkeeping Business Financial Analysis

Chapter 7 Working Capital Management

Small Business Advice Accounts Receivable Small Business Advice Accounting

Chapter 7 Working Capital Management

Chapter 7 Working Capital Management

Working Capital Turnover Economics Lessons Financial Management Budgeting Finances

Calculate The Change In Working Capital And Free Cash Flow

Efficiency Ratios Financial Analysis Financial Strategies Budgeting Money

Chapter 7 Working Capital Management

Chapter 7 Working Capital Management

Asset Turnover Ratio Definition Analysis Formula Example Tally Solutions

Working Capital Turnover Economics Lessons Financial Management Accounting And Finance

Creditor Payables Days Tutor2u Business Financial Ratio Small Business Tools Economic Research

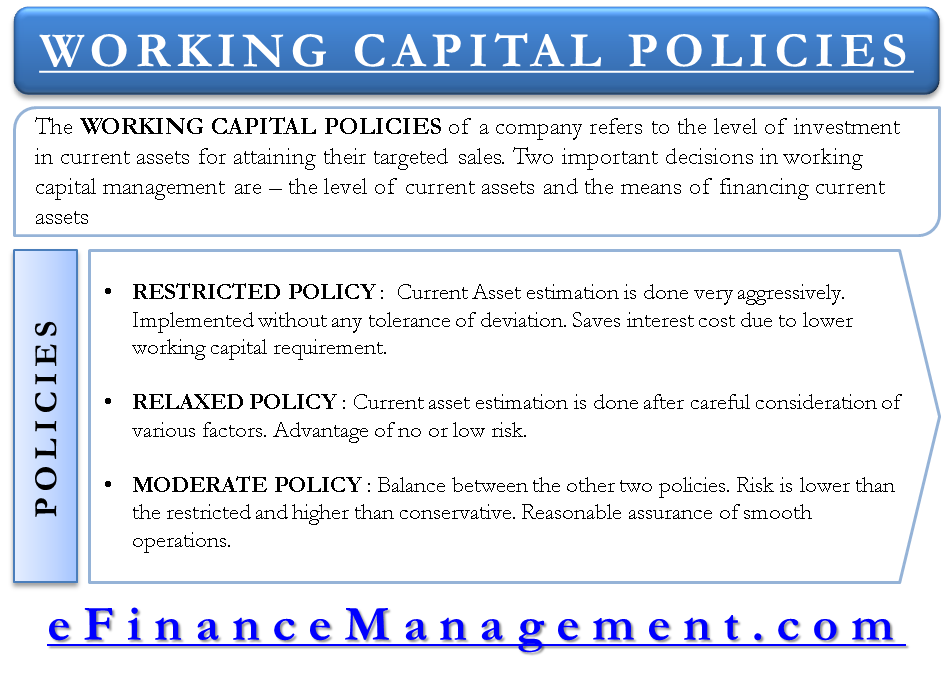

Working Capital Policy Relaxed Restricted And Moderate

4 Best Financial Ratio Analysis Technique Discussed Briefly Educba Financial Ratio Trade Finance Financial Analysis